Company Liquidation in Abu Dhabi refers to the official prepare of closing down a commerce inside the nation. It can moreover be called "winding up" or "closing" a commerce. Within the handle of liquidation, the company offers all its resources to pay off any remaining obligations and costs. Once these commitments are settled, the remaining reserves may well be shared among the shareholders of the company.

When a company experiences liquidation, it ceases operations and ceases to utilize people. The company's commerce permit is repudiated amid the liquidation method, and its title is expelled from the Exchange Registry. The government presently considers the company to be non-existent.

Company Liquidation in Abu Dhabi can be a complex and long strategy. In any case, our outlets in Abu Dhabi, UAE, have the skill and encounter to streamline all lawful forms and help you in closing down your business.

One figure that leads to the closure of businesses in Dubai is the insufficient money related assets for every day operations or the failure to produce sufficient salary to cover costs and debts.

Another critical cause for a company to go out of commerce may be the event of false exercises or a breach of laws and directions coming about within the closure of the company.

If the shareholders cannot be present in the UAE, the resolution/Power of Attorney must be notarized and authenticated by the UAE embassy in that country and legalized by the Ministry of Foreign Affairs and Ministry of Justice in the UAE. Notary Public attestation is not needed for companies registered in the majority of Free Zones. The resolution should include the company's liquidator's appointment details, such as the name and full address of the liquidator. Furthermore, when dissolving a company, this procedure does not apply to sole proprietorships.

There are two types of company liquidation in Abu Dhabi exist based on the cause of the liquidation. Those individuals are:

The Formal process of Company Liquidation in Abu Dhabi is as follows:

The shareholders need to draft and approve the resolution for the dissolution of the company. The resolution for LLCs registered in the UAE must be officially certified by a Notary Public.

If the shareholders are not in the UAE in person, the resolution needs to be notarized and then authenticated by the UAE Ministry of Foreign Affairs and Ministry of Justice, at the appropriate UAE embassy. The majority of Free Zone businesses must obtain notarization for their documents from a Notary Public.

An individual to act as liquidator needs to be designated, and a formal letter of acceptance from the liquidator must be obtained.

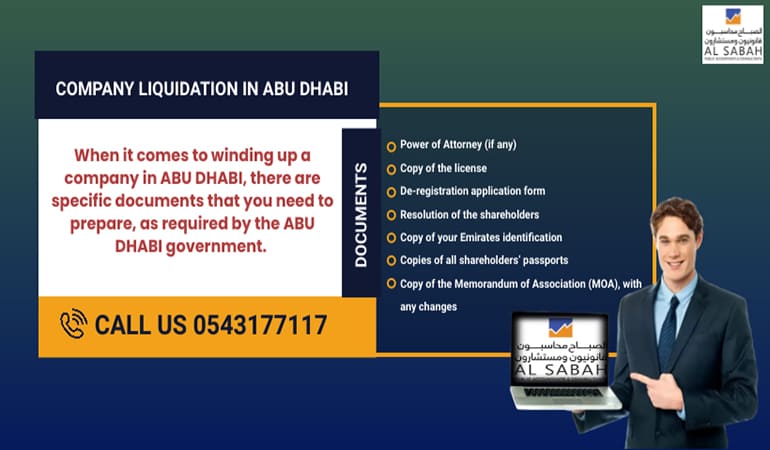

The shareholders must submit the resolution to the proper licensing authority, along with all necessary paperwork and fees. The necessary documents needed are a duplicate of the business's Trade Licence, Memorandum of Association, Powers of Attorney (if needed), and copies of passport or Emirates ID for every partner, owner, and shareholder. Furthermore, the submission of a form for deregistration is required.

After receiving a temporary liquidation certificate, the company must post a liquidation announcement in a publicly available publication. The notice should be published in both English and Arabic versions as well. Different notification requirements may apply based on the registered authority, typically needing two to four notices.

Depending on the registration jurisdiction, it may be necessary to provide a notice period of up to 45 days. At this time, the following activities are allowed.:

Once the notice period is over, the designated liquidator will start preparing the Liquidation Report. The report and all necessary supporting documents must be sent to the competent Authority. Payment of cancellation fees is also required. Upon completion of the application review, the Authority will provide a "License Cancellation Certificate" in the case of approval.